6 Common Questions About Foreclosure

Facing foreclosure can be overwhelming, especially if you’re unsure about how the process works or what options you have. Whether you’re struggling to keep up with mortgage payments, trying to understand the legal steps involved, or just looking for ways to avoid losing your home, you’re not alone.

Many homeowners have the same concerns, and having the right information can make a great deal of difference. In this article, we’ll go over six of the most common questions people ask about foreclosure. We’ll break things down in simple terms, ensuring you have all the information you need to protect yourself.

What is Foreclosure?

Foreclosure is a legal process in which a lender reclaims a property when the homeowner fails to keep up with mortgage payments. It typically follows a structured legal procedure, often involving court intervention, and results in the homeowner losing ownership of the property.

Beyond losing their home, foreclosure can severely affect a homeowner’s financial standing, including a major drop in their credit score. However, homeowners facing foreclosure may have options to negotiate with their lender to avoid losing the property entirely.

What Happens During the Foreclosure Process?

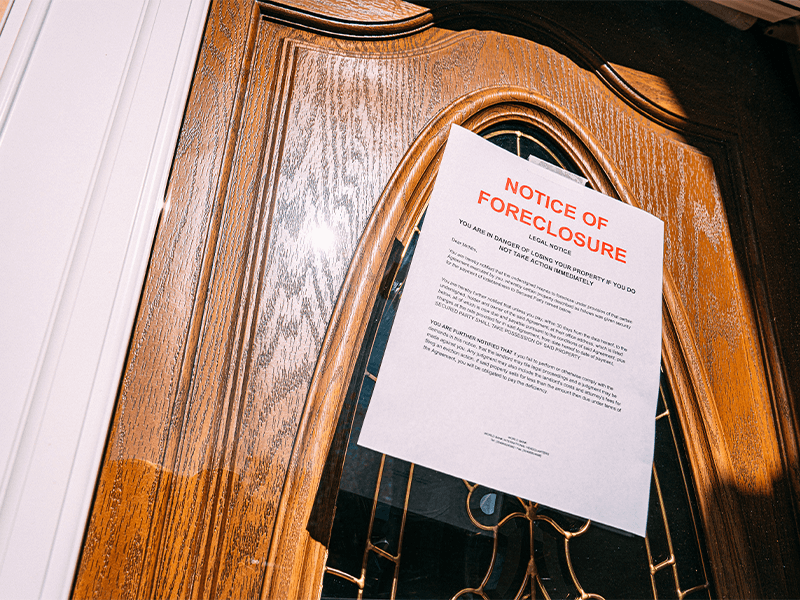

Foreclosure begins when a homeowner misses a mortgage payment. The lender first issues a notice of the overdue amount, giving the homeowner a deadline to catch up on payments. If payments remain unpaid, the lender may escalate the process by filing a legal claim.

Once the case moves to court, the legal system oversees the proceedings to ensure due process. If no resolution is reached, the property is eventually scheduled for a public auction, where buyers can bid under regulated conditions.

Can Foreclosure Be Prevented?

Homeowners can take steps to prevent foreclosure by addressing missed mortgage payments as soon as possible. Communicating with the lender early often opens up options for resolving the issue before it escalates.

Lenders may offer solutions such as loan modifications, repayment plans, or temporary forbearance programs that provide financial relief. Seeking guidance from financial counselors or legal professionals can also help homeowners navigate their options and improve their financial standing.

Taking proactive steps and negotiating timely agreements with the lender can reduce the risk of losing the property and provide a path to keeping the home.

How Does Bankruptcy Affect Foreclosure?

Filing for bankruptcy can temporarily pause foreclosure proceedings while the court reviews the homeowner’s financial situation. This legal protection, known as an automatic stay, gives homeowners time to explore debt restructuring options.

During bankruptcy, lenders must follow court regulations, which may impact their approach to foreclosure. However, filing for bankruptcy does not erase mortgage debt. Once the bankruptcy process concludes, foreclosure may resume if payments remain unresolved.

While bankruptcy can offer short-term relief, it is not always a permanent solution to avoid foreclosure. Homeowners should weigh their options carefully before choosing this route.

What Are the Consequences of Losing a Home to Foreclosure?

Losing a home to foreclosure can have serious financial consequences, including a major hit to the homeowner’s credit score and future borrowing ability. It can also disrupt long-term financial plans and create challenges in securing new loans.

A foreclosure remains on a credit report for several years and makes it harder to qualify for future financing or obtain favorable loan terms. Higher borrowing costs and financial instability often follow, which make it essential for affected homeowners to develop a structured recovery plan.

What Should I Do If I’m Facing Foreclosure?

Homeowners at risk of foreclosure should act quickly to explore their options. Seeking guidance from financial experts or foreclosure attorneys can provide clarity on possible solutions and legal rights.

Reaching out to the lender at the first sign of difficulty may open the door to repayment plans, loan modifications, or temporary relief programs. Reviewing available legal and financial resources can also help reduce the risk of losing the home.

Taking proactive steps early, meanwhile, improves the chances of finding a workable solution and avoiding long-term financial setbacks.

Don’t Wait Until It’s Too Late!

At Sirody Bankruptcy Center, we’ve helped countless homeowners come out on top of the foreclosure process, explore bankruptcy solutions, and take control of their financial future. If you’re facing foreclosure, time is critical. The sooner you act, the more options you have. Our experienced legal team can help you understand your rights, negotiate with lenders, and determine the best path forward. Contact us today for a free consultation!