Our Commitment

Sirody Bankruptcy Center is committed to providing you with the best, most experienced bankruptcy lawyers in the Baltimore area and making the bankruptcy process as easy and stress-free as possible.

Our firm provides clients with relief from their debt, along with the opportunity to rebuild their credit and get the fresh start they deserve. We offer a range of specialized services, including real estate loans, mortgage services, and bankruptcy buyouts, that go beyond what most bankruptcy lawyers provide. Give us the opportunity to help you today and begin to restore your financial life.

Practice Areas

Chapter 7 Bankruptcy

Chapter 7 is a section of the Bankruptcy Code that helps individuals who have an income below that of the state median eliminate debts and put a stop to collections activities.

Chapter 13 Bankruptcy

Chapter 13 is a section of the Bankruptcy Code that helps individuals, or small business owners, reduce and reorganize debts with a reasonable repayment plan that they can afford.

Stop Foreclosure!

Are you at risk of losing your home in foreclosure? Sirody Bankruptcy Center will help you protect your most valuable possession, your home.

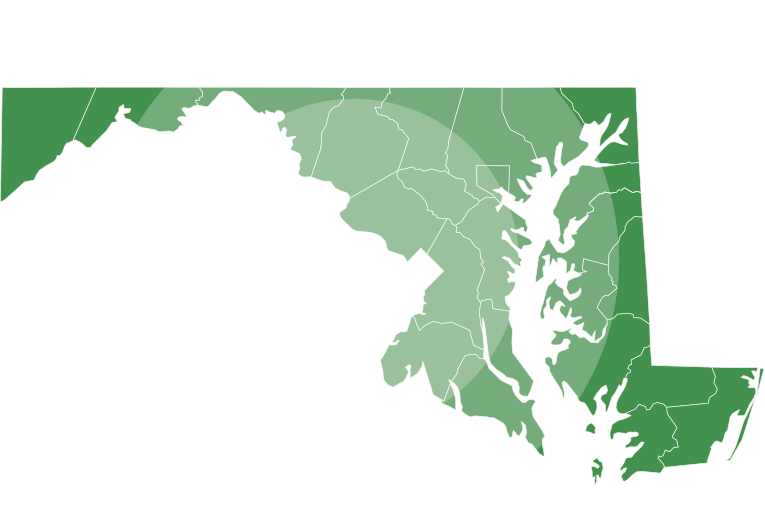

Service Area

Sirody Bankruptcy Center has successfully helped thousands of Marylanders just like you get the fresh start they deserve.

Pay Your Invoice Online

We make it easy to pay your invoice online. By law, debtors may not use credit cards to pay bankruptcy fees, but debit cards may be used.

REAL REVIEWS FROM REAL CLIENTS

FAQs

What is Chapter 7 bankruptcy, and how can it help me?

Am I eligible for Chapter 7 bankruptcy in Maryland?

To qualify for Chapter 7 bankruptcy in Maryland, you must pass a “means test,” which compares your income to the state median. If your income falls below the median or you meet other specific conditions, you may be eligible. Speaking with an experienced bankruptcy attorney at Sirody Bankruptcy Center will help you understand your eligibility and navigate the process.

How long does the Chapter 7 bankruptcy process take in Maryland?

The Chapter 7 bankruptcy process in Maryland typically takes about four to six months from filing to discharge. However, the duration may vary depending on individual circumstances, such as the complexity of your financial situation. Consulting with Sirody & Ruben can provide a clearer timeline based on your case.

What is Chapter 13 bankruptcy, and how does it work?

Chapter 13 bankruptcy is a form of debt reorganization that allows individuals with regular income to create a repayment plan for their debts over a period of three to five years. Unlike Chapter 7, Chapter 13 helps you keep your assets while making manageable payments to creditors. This option is ideal for those who are behind on secured debts like mortgages or car loans but want to retain their property.

How does bankruptcy affect my credit?

Both Chapter 7 and Chapter 13 bankruptcies will negatively impact your credit score. Chapter 7 remains on your credit report for 10 years, while Chapter 13 remains for seven years after completion of the repayment plan. However, filing for bankruptcy may offer relief from unmanageable debt and a chance to rebuild your financial future.

Which bankruptcy option is better for me?

The best option depends on your financial situation. Chapter 7 may be better if you have little income and many unsecured debts, while Chapter 13 may be more appropriate if you have a steady income and wish to keep your assets while repaying some of your debt.